Preparing for Bitcoin Halving 2024: Strategies for Maximizing Your Investments

Understanding Bitcoin halving

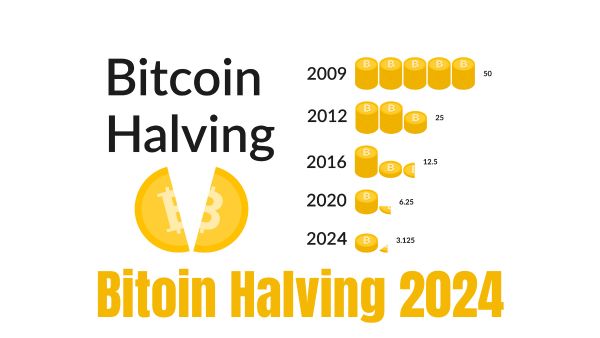

Bitcoin halving is an event that occurs approximately every four years in the Bitcoin network. It is a programmed reduction in the block reward, which is the amount of Bitcoin miners receive for successfully mining and verifying transactions. The purpose of this halving is to control the supply of Bitcoin and ensure its scarcity, similar to how gold is a limited resource.

During a Bitcoin halving, the block reward is cut in half. In the early days of Bitcoin, the block reward was 50 BTC, but it has since been reduced to 6.25 BTC. This reduction in supply has a significant impact on the market and affects various aspects of the cryptocurrency ecosystem.

The impact of Bitcoin halving on the market

Bitcoin halving has a profound impact on the market, especially in terms of price volatility and mining profitability. The reduction in the block reward means that miners receive fewer Bitcoins for their efforts, which can affect their profitability. As a result, some miners may choose to exit the market, leading to a decrease in hash rate and potentially affecting the security and stability of the Bitcoin network.

On the other hand, the reduction in supply can also create scarcity, which can drive up the price of Bitcoin. This has been observed in previous halvings, where the price of Bitcoin experienced significant bull runs after the event. Investors and traders often anticipate these price movements and adjust their strategies accordingly.

Bitcoin halving history and trends

Bitcoin halving has occurred twice in the past, first in 2012 and then in 2016. Each halving event has been followed by a significant increase in the price of Bitcoin. In the 2012 halving, the price of Bitcoin increased from around $12 to over $1000 within a year. Similarly, the 2016 halving saw the price surge from around $650 to nearly $20,000 in the following year.

These historical trends have led many investors to believe that the next halving in 2024 will result in another bullish market. However, it is important to note that past performance is not indicative of future results, and the cryptocurrency market can be highly volatile and unpredictable.

Preparing for Bitcoin halving 2024

With the next Bitcoin halving scheduled for 2024, it is crucial for investors to prepare and develop strategies to maximize their investments. Here are some key steps to consider:

Diversifying your cryptocurrency portfolio

While Bitcoin is the most well-known and dominant cryptocurrency, it is important to diversify your portfolio to mitigate risk. Investing in a mix of different cryptocurrencies can help spread out your investments and potentially increase your chances of profiting from the market.

Research and identify promising altcoins that have strong fundamentals and potential for growth. Consider factors such as the team behind the project, the technology, and the market demand for the cryptocurrency. By diversifying your portfolio, you can reduce the impact of any single cryptocurrency’s performance on your overall investment.

Investing in Bitcoin mining

Another strategy to consider is investing in Bitcoin mining. As mentioned earlier, Bitcoin halving reduces the block reward, making mining less profitable for some miners. However, if you have the resources and technical expertise, investing in mining equipment and joining a mining pool can still be a lucrative venture.

Keep in mind that mining requires a significant upfront investment in equipment and electricity costs. It is essential to carefully consider your budget and calculate the potential returns before diving into mining. Additionally, stay updated on the latest mining trends and technologies to ensure you are maximizing your mining efficiency.

Staying informed and updated on the market

The cryptocurrency market is highly dynamic and constantly evolving. To make informed investment decisions, it is crucial to stay updated on the latest market trends, news, and regulations. Follow reputable cryptocurrency news sources, join online communities, and engage with other investors and experts in the field.

Stay updated on the progress of Bitcoin’s development and any potential changes to its underlying technology. Being knowledgeable about the market can help you identify opportunities and make well-informed decisions.

The future of Bitcoin after halving

While Bitcoin halving events have historically been followed by bullish market trends, it is important to approach the future with caution. The cryptocurrency market is highly volatile and subject to various external factors, such as regulatory changes and global economic conditions.

The future of Bitcoin after the 2024 halving will depend on various factors, including the adoption of Bitcoin as a mainstream payment method, institutional investment, and the development of new technologies and use cases for cryptocurrencies. It is essential to stay updated on these developments and adjust your investment strategies accordingly.

Conclusion

Bitcoin halving is a significant event in the cryptocurrency market that has a profound impact on various aspects of the ecosystem. By understanding the history and trends of Bitcoin halving, investors can develop strategies to maximize their investments.

Diversifying your cryptocurrency portfolio, investing in Bitcoin mining, and staying informed about the market are key steps to consider. However, it is important to remember that the market is highly volatile and unpredictable, and past performance is not indicative of future results.

To prepare for Bitcoin halving 2024, conduct thorough research, stay updated on market trends, and consult with experts in the field. By taking a strategic approach, you can position yourself to potentially benefit from the opportunities presented by Bitcoin halving.

BlackRock’s ETFs: A Titan Compared, But Not Unchallenged

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions.

Related Job Updates

- iShares Bitcoin Trust (IBIT): Price Prediction & Forecast 2024-2030

- Day Trading Altcoins: A High-Risk High-Reward Guide

Latest Job Posts

- TGTRANSCO Recruitment 2026: 250 Apprentice Posts for BE/BTech & Diploma

- UPSC Recruitment 2026: Apply Online for 349 Assistant Commandant Vacancies @upsc.gov.in

- GAIL Recruitment 2026: 70 Executive Trainee Vacancies, Apply Online from 20 Feb

- DSSSB Recruitment 2026: 911 Vacancies for JE, AE, Legal Assistant, Apply from 24 Feb

- RRB ALP Vacancy 2026: 11,127 Posts Approved – Notification Date & Eligibility

Important Sections:

All Jobs | Admit Cards | Results | Answer Keys | Homepage