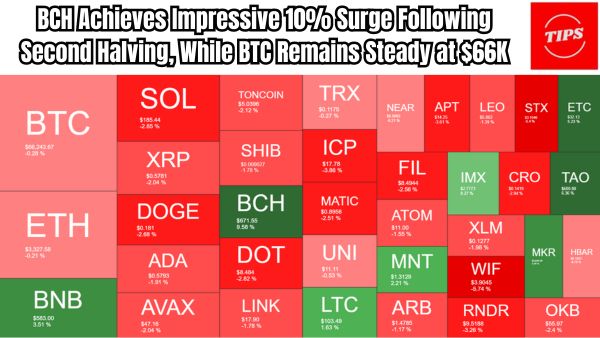

BCH Achieves Impressive 10% Surge Following Second Halving, While BTC Remains Steady at $66K

Understanding Bitcoin Cash (BCH) and Bitcoin (BTC)

Bitcoin Cash (BCH) and Bitcoin (BTC) are both popular cryptocurrencies that have gained significant attention in the digital asset market. While they share some similarities, they also have distinct characteristics that set them apart. It is crucial to have a clear understanding of these digital currencies to comprehend the recent surge in BCH following its second halving event and the steady performance of BTC at $66K.

What is a halving event?

A halving event is a predetermined adjustment in the mining reward given to miners for solving complex mathematical problems on the blockchain network. This mechanism aims to control the inflation rate of the cryptocurrency and gradually reduce the supply of new coins. The halving event occurs at specific intervals, and for Bitcoin Cash, it takes place approximately every four years.

The significance of BCH completing its second halving

BCH recently completed its second halving event, which has garnered considerable attention from investors and enthusiasts alike. The halving event in BCH reduces the block reward by 50%, resulting in a decreased supply of new coins entering the market. This reduction in supply often creates a sense of scarcity, leading to upward price pressure. The completion of the second halving for BCH signifies a milestone in its development, highlighting its longevity and potential as a store of value.

The impact of halving events on cryptocurrency prices

Halving events have historically had a significant impact on cryptocurrency prices. The reduction in the block reward creates a supply shock, often leading to an increase in demand and subsequently driving up the price. This phenomenon can be attributed to the basic principles of supply and demand economics. With a decrease in the supply of new coins, the existing supply becomes relatively scarcer, driving up its perceived value.

Factors contributing to BCH’s 10% surge

The recent surge of 10% in BCH following its second halving can be attributed to various factors. Firstly, the halving event created a sense of scarcity, which increased investor interest in the cryptocurrency. This surge in demand, coupled with a limited supply, created upward price pressure. Additionally, positive market sentiment surrounding the overall cryptocurrency market, driven by institutional adoption and increased mainstream acceptance, further contributed to BCH’s surge.

Analyzing BTC’s stability at $66K

While BCH experienced a notable surge following its halving event, Bitcoin (BTC) remained relatively steady at $66K. BTC’s stability can be attributed to its strong market position and widespread adoption. As the largest cryptocurrency by market capitalization, BTC has established itself as a reliable store of value and a preferred investment option for many institutional investors. This stability reflects the confidence investors have in BTC’s long-term potential and its ability to weather market fluctuations.

Comparing the performance of BCH and BTC post-halving

The performance of BCH and BTC following their respective halving events provides interesting insights into their market dynamics. While BCH experienced a significant surge in price, BTC’s stability showcases its resilience and maturity as a digital asset. This divergence in performance can be attributed to various factors, including market sentiment, investor preferences, and the overall perception of each cryptocurrency. Both BCH and BTC have their unique value propositions, and their post-halving performance reinforces the need for investors to diversify their cryptocurrency portfolios.

Market reactions and investor sentiment

The market reactions to BCH’s 10% surge and BTC’s stability at $66K have been mixed. Some investors view BCH’s surge as a positive indicator of its potential as a growth asset, while others remain skeptical about its long-term sustainability. The stability of BTC at a high price range has been viewed favorably by many investors, reinforcing their belief in BTC’s status as a reliable store of value. Overall, market reactions and investor sentiment indicate a growing interest in cryptocurrencies as a viable investment option.

Potential future implications for BCH and BTC

The completion of BCH’s second halving event and BTC’s stability at $66K have significant future implications for both cryptocurrencies. For BCH, the successful completion of its halving highlights its resilience and potential to compete with established cryptocurrencies like BTC. This event may attract more investors and increase BCH’s market presence. As for BTC, its stability at a high price range reinforces its position as the leading cryptocurrency and further solidifies its status as a safe haven asset. Both BCH and BTC are likely to continue attracting investor interest and contribute to the overall growth of the cryptocurrency market.

Conclusion: The future of BCH and BTC following their respective halving events

The recent surge in BCH following its second halving event and the stability of BTC at $66K indicate a promising future for both cryptocurrencies. BCH’s surge demonstrates its potential as a growth asset, while BTC’s stability reinforces its position as a reliable store of value. The completion of the halving events for both cryptocurrencies highlights their longevity and resilience in an ever-changing market. As the cryptocurrency market continues to evolve, BCH and BTC are likely to play significant roles in shaping its future. Investors should carefully consider both cryptocurrencies as part of a diversified investment strategy.

Invest in the future of cryptocurrencies with BCH and BTC. Start your investment journey today!

Related Job Updates

- CVX Crypto: The Future of Convex Finance (CVX)

- Exploring the Features and Benefits of Bingx Exchange: Your Ultimate No 1 Trading Platform

Latest Job Posts

- UPSC IES ISS Notification 2026 OUT: 44 Vacancies, Apply by 3 March | Age Limit & Eligibility

- NTPC Executive Trainee Recruitment 2026: 515 Vacancies, Apply Online from 11 Feb

- IOCL Recruitment 2026: 121 Apprentice Vacancies – Apply Online for B.Sc & Diploma

- CSBC Constable Recruitment 2026: 83 Vacancies, Apply Online Feb 6 – Mar 5

- UP B.Ed. JEE 2026 Application Form Out: Apply at bundelkhanduniversity.ac.in by Mar 5

Important Sections:

All Jobs | Admit Cards | Results | Answer Keys | Homepage